How Long Must Tax Preparers Keep Records . Companies with dec financial year end. Web you should keep proper records and accounts for 5 years so that the income earned and business expenses claimed. Web how long records should be retained depends on a variety of factors including, but not limited to: Web a tax preparer is expected to keep tax records for at least three years. Web your company must retain its records for at least 5 years from the relevant ya. Web keep records for 3 years if situations (4), (5), and (6) below do not apply to you. Keep records for 3 years from the. Guidance on restrictions during suspension or disbarment from practice.

from www.illinoisrealtors.org

Web you should keep proper records and accounts for 5 years so that the income earned and business expenses claimed. Keep records for 3 years from the. Guidance on restrictions during suspension or disbarment from practice. Web a tax preparer is expected to keep tax records for at least three years. Web your company must retain its records for at least 5 years from the relevant ya. Web how long records should be retained depends on a variety of factors including, but not limited to: Companies with dec financial year end. Web keep records for 3 years if situations (4), (5), and (6) below do not apply to you.

Morning Minute Already got your taxes done? Find a checklist for how

How Long Must Tax Preparers Keep Records Guidance on restrictions during suspension or disbarment from practice. Web a tax preparer is expected to keep tax records for at least three years. Keep records for 3 years from the. Guidance on restrictions during suspension or disbarment from practice. Companies with dec financial year end. Web your company must retain its records for at least 5 years from the relevant ya. Web you should keep proper records and accounts for 5 years so that the income earned and business expenses claimed. Web how long records should be retained depends on a variety of factors including, but not limited to: Web keep records for 3 years if situations (4), (5), and (6) below do not apply to you.

From blog.eztaxreturn.com

Tax records What to keep and for how long? How Long Must Tax Preparers Keep Records Web how long records should be retained depends on a variety of factors including, but not limited to: Keep records for 3 years from the. Web keep records for 3 years if situations (4), (5), and (6) below do not apply to you. Web you should keep proper records and accounts for 5 years so that the income earned and. How Long Must Tax Preparers Keep Records.

From www.officemanagertoday.com

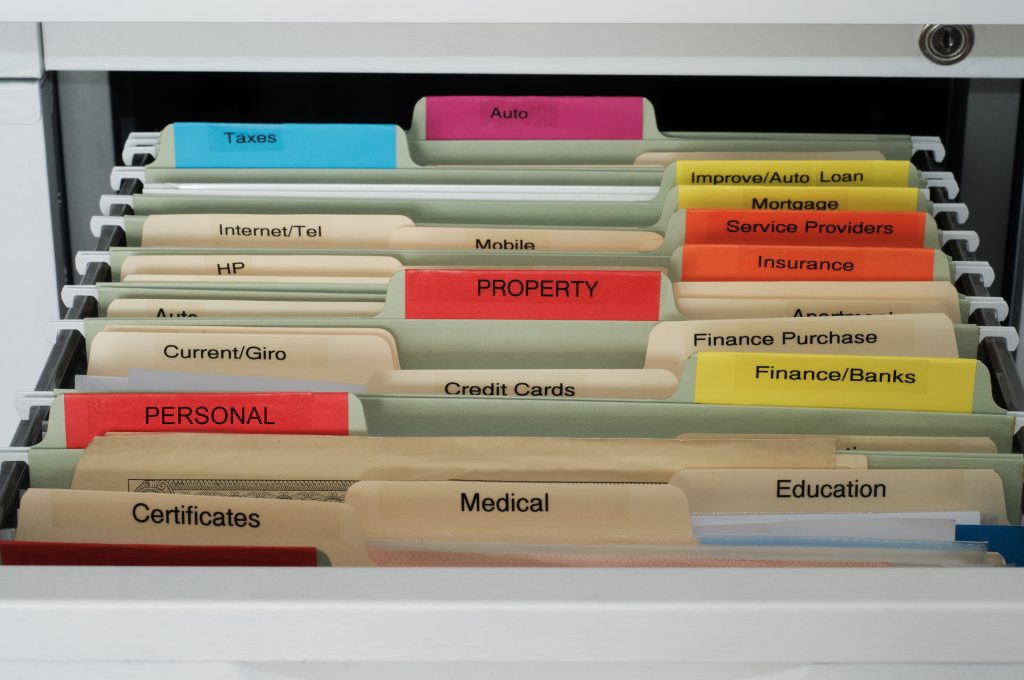

Records retention How long should you keep each document? How Long Must Tax Preparers Keep Records Web your company must retain its records for at least 5 years from the relevant ya. Web you should keep proper records and accounts for 5 years so that the income earned and business expenses claimed. Web keep records for 3 years if situations (4), (5), and (6) below do not apply to you. Guidance on restrictions during suspension or. How Long Must Tax Preparers Keep Records.

From www.hss-ca.com

How Long Do I Have to Keep My Business Tax Records? Hogg, Shain & Scheck How Long Must Tax Preparers Keep Records Web a tax preparer is expected to keep tax records for at least three years. Keep records for 3 years from the. Web you should keep proper records and accounts for 5 years so that the income earned and business expenses claimed. Web keep records for 3 years if situations (4), (5), and (6) below do not apply to you.. How Long Must Tax Preparers Keep Records.

From www.pinterest.com

How Long Should You Keep Tax Returns? The IRS generally How Long Must Tax Preparers Keep Records Guidance on restrictions during suspension or disbarment from practice. Keep records for 3 years from the. Web keep records for 3 years if situations (4), (5), and (6) below do not apply to you. Companies with dec financial year end. Web a tax preparer is expected to keep tax records for at least three years. Web your company must retain. How Long Must Tax Preparers Keep Records.

From www.ecsfinancial.com

Records Retention What Should You Keep and For How Long? How Long Must Tax Preparers Keep Records Web your company must retain its records for at least 5 years from the relevant ya. Web you should keep proper records and accounts for 5 years so that the income earned and business expenses claimed. Web keep records for 3 years if situations (4), (5), and (6) below do not apply to you. Web a tax preparer is expected. How Long Must Tax Preparers Keep Records.

From shredbull.com

Taxes How Long Should I Keep My Financial Records? How Long Must Tax Preparers Keep Records Guidance on restrictions during suspension or disbarment from practice. Web a tax preparer is expected to keep tax records for at least three years. Keep records for 3 years from the. Web you should keep proper records and accounts for 5 years so that the income earned and business expenses claimed. Companies with dec financial year end. Web how long. How Long Must Tax Preparers Keep Records.

From mavink.com

Tax Return Retention Chart How Long Must Tax Preparers Keep Records Web you should keep proper records and accounts for 5 years so that the income earned and business expenses claimed. Web keep records for 3 years if situations (4), (5), and (6) below do not apply to you. Keep records for 3 years from the. Web a tax preparer is expected to keep tax records for at least three years.. How Long Must Tax Preparers Keep Records.

From vyde.io

What Business Records You Should Keep for Tax Purposes Vyde How Long Must Tax Preparers Keep Records Keep records for 3 years from the. Companies with dec financial year end. Web your company must retain its records for at least 5 years from the relevant ya. Web a tax preparer is expected to keep tax records for at least three years. Web how long records should be retained depends on a variety of factors including, but not. How Long Must Tax Preparers Keep Records.

From www.gobankingrates.com

How Long to Keep Tax Records Can You Ever Throw Them Away How Long Must Tax Preparers Keep Records Keep records for 3 years from the. Web keep records for 3 years if situations (4), (5), and (6) below do not apply to you. Guidance on restrictions during suspension or disbarment from practice. Web how long records should be retained depends on a variety of factors including, but not limited to: Web a tax preparer is expected to keep. How Long Must Tax Preparers Keep Records.

From www.juststartinvesting.com

How Long to Keep Tax Returns 7 Questions to Consider Just Start How Long Must Tax Preparers Keep Records Web a tax preparer is expected to keep tax records for at least three years. Web keep records for 3 years if situations (4), (5), and (6) below do not apply to you. Keep records for 3 years from the. Guidance on restrictions during suspension or disbarment from practice. Web your company must retain its records for at least 5. How Long Must Tax Preparers Keep Records.

From www.mynextmove.org

Tax Preparers at My Next Move How Long Must Tax Preparers Keep Records Web how long records should be retained depends on a variety of factors including, but not limited to: Guidance on restrictions during suspension or disbarment from practice. Web your company must retain its records for at least 5 years from the relevant ya. Web a tax preparer is expected to keep tax records for at least three years. Companies with. How Long Must Tax Preparers Keep Records.

From www.realtyexecutives.com

How Long to Keep Tax Records and More A Checklist How Long Must Tax Preparers Keep Records Companies with dec financial year end. Web how long records should be retained depends on a variety of factors including, but not limited to: Guidance on restrictions during suspension or disbarment from practice. Web a tax preparer is expected to keep tax records for at least three years. Keep records for 3 years from the. Web keep records for 3. How Long Must Tax Preparers Keep Records.

From rightfitadvisors.ca

How Long To Keep Tax Records in Canada Tax Help RightFit Advisors How Long Must Tax Preparers Keep Records Web you should keep proper records and accounts for 5 years so that the income earned and business expenses claimed. Web keep records for 3 years if situations (4), (5), and (6) below do not apply to you. Web your company must retain its records for at least 5 years from the relevant ya. Guidance on restrictions during suspension or. How Long Must Tax Preparers Keep Records.

From www.communitytax.com

How Long Should I Keep Tax Records? Community Tax How Long Must Tax Preparers Keep Records Companies with dec financial year end. Keep records for 3 years from the. Web how long records should be retained depends on a variety of factors including, but not limited to: Web keep records for 3 years if situations (4), (5), and (6) below do not apply to you. Web a tax preparer is expected to keep tax records for. How Long Must Tax Preparers Keep Records.

From www.taxestalk.net

How Long To Keep Tax Records How Long Must Tax Preparers Keep Records Web your company must retain its records for at least 5 years from the relevant ya. Web how long records should be retained depends on a variety of factors including, but not limited to: Web a tax preparer is expected to keep tax records for at least three years. Web you should keep proper records and accounts for 5 years. How Long Must Tax Preparers Keep Records.

From www.freshbooks.com

Tax Records How Long Do You Have to Keep Them? Freshbooks How Long Must Tax Preparers Keep Records Web your company must retain its records for at least 5 years from the relevant ya. Web a tax preparer is expected to keep tax records for at least three years. Web keep records for 3 years if situations (4), (5), and (6) below do not apply to you. Guidance on restrictions during suspension or disbarment from practice. Companies with. How Long Must Tax Preparers Keep Records.

From www.rocketlawyer.com

How Long to Keep Records for Business Taxes Rocket Lawyer How Long Must Tax Preparers Keep Records Web you should keep proper records and accounts for 5 years so that the income earned and business expenses claimed. Web your company must retain its records for at least 5 years from the relevant ya. Web how long records should be retained depends on a variety of factors including, but not limited to: Companies with dec financial year end.. How Long Must Tax Preparers Keep Records.

From swrmissouricpa.com

How Long To Keep Those Tax Records Tax Accountant in Missouri How Long Must Tax Preparers Keep Records Web you should keep proper records and accounts for 5 years so that the income earned and business expenses claimed. Companies with dec financial year end. Web your company must retain its records for at least 5 years from the relevant ya. Web keep records for 3 years if situations (4), (5), and (6) below do not apply to you.. How Long Must Tax Preparers Keep Records.